Your Tax Increase Just Funded Another Developer

It is fascinating and disturbing to watch taxpayers vote for school levies, thinking they are helping kids. Then watch that same money get funneled to wealthy developers building luxury condos.

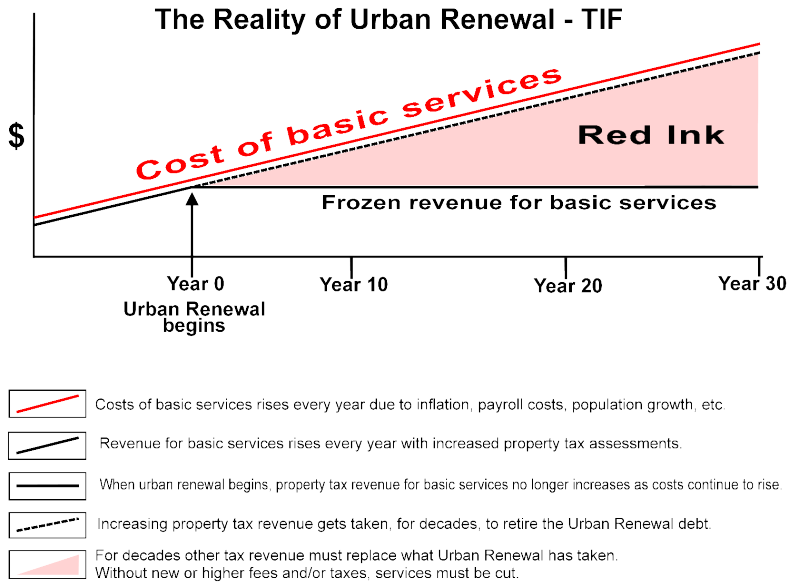

It is the shell game of Tax Increment Financing. Most people have never heard of it, but it is quietly redistributing billions in tax revenue away from schools, libraries, law enforcement, and other essential services.

The mechanism is elegant in its deception.

How the Shell Game Works

When you vote for a tax increase, you think you know where that money goes. Schools receive their share, the county gets its share, and libraries, law enforcement, and fire departments are funded.

But in Urban Renewal districts, something different happens.

The city captures all the increased property tax revenue and hands it to developers. They call it "Tax Increment Financing" because it sounds technical and boring.

It should be called artificial gentrification.

Real gentrification happens when people with higher incomes move into neighborhoods and make improvements with their own money. Artificial gentrification occurs when tax dollars fund luxury developments that displace existing residents.

The difference matters because one is market-driven and the other is taxpayer-subsidized displacement. The practice disregards consumer demands in favor of the city planner's desires, sending misleading signals to the market.

The Double-Hit to Taxpayers

Here's where it gets worse. When Urban Renewal diverts your tax money to developers, the regular taxing districts still need to operate.

So they come back to you for another tax increase.

You get hit twice. First, your original tax increase gets redirected to a developer's pocket. Second, you get asked to pay again to fund the services you thought you had already invested in.

In California alone, redevelopment agencies captured $1.5 billion annually that would have otherwise gone to schools and public services.

That's $1.5 billion in double taxation.

When School Boards Fight Back

Most school districts are unaware that they can resist this theft. They rubber-stamp these deals without understanding the consequences.

But occasionally, a school board educates itself.

The North Bend School District in Coos County, Oregon, did something remarkable. When the city wanted to expand its Urban Renewal debt from $11 million to $44 million, the school board said no.

They had done their homework.

The board members read studies on Tax Increment Financing and discovered something crucial. Areas outside urban renewal districts were developing at the same rate as those inside them.

Urban Renewal wasn't accelerating development. It was just redistributing who pays for it.

The North Bend School Board voted against the amendment, effectively blocking the city's expansion of its tax diversion scheme.

They also discovered that the state Common School Fund, intended to support school districts, would not benefit the other affected districts. Only schools get the state backfill money.

Libraries, fire departments, and county services would have received nothing, which would have been a heavy burden on an already economically depleted county.

The "But For" Lie

When confronted with evidence that development happens anyway, cities and developers retreat to their standard defense.

They claim that development would not have happened "but for" the tax subsidy.

It is the central lie of Urban Renewal. Research shows that non-TIF areas of municipalities grow at no more rapid rate than similar municipalities that don't use TIF at all.

The "but for" argument is what economists refer to as a "pro forma exercise." Specialized consultants can produce the needed evidence in almost any case.

Translation: it's bureaucratic theater designed to justify predetermined outcomes.

The Prosperity Paradox Exposed

There is a revealing and more profound contradiction at the heart of modern urban development.

Cities celebrate rising property values and new investment as signs of economic success. Meanwhile, they are using taxpayer money to fund developments that displace the very taxpayers who made those investments possible.

The "successful" development downtown that politicians brag about? You paid for it twice.

First, through the diverted taxes that should have gone to your kids’ school and the other regular taxing districts. Second, through the higher taxes you will pay to make up for the diverted revenue.

The developer gets rich. The politician gets a ribbon-cutting ceremony. You get the bill.

The Scale of the Problem

Artificial Gentrification is not happening in just a few cities. Tax Increment Financing has become the standard playbook for municipal development nationwide.

The diversions can last 15, 23, 35, or even 50 years. In some states, they can be renewed indefinitely.

That means decades of your tax dollars flowing to private developers instead of public services.

California eventually woke up to this scam. Facing massive budget deficits, the state eliminated nearly 400 redevelopment agencies and stopped the diversion of property tax revenues.

Unfortunately, most states haven't caught on yet.

Questions You Should Ask

The next time your city announces a plan for a successful development project, ask who is going to pay for it.

When they celebrate rising property values, ask what happened to the people who used to live there, as well as the current residents who cannot afford the tax increases.

When they claim that economic development requires tax subsidies, ask to see the studies that prove development would not happen otherwise.

Most importantly, when your school district, the library, or any other regular taxing district requests additional funding, aka, tax hikes, ask whether Urban Renewal is diverting money that should be allocated to those services.

In Conclusion

The prosperity paradox is not just an abstract economic concept. It's a concrete policy choice that redistributes wealth from taxpayers to developers while labeling it economic development.

Understanding Tax Increment Financing is understanding how the shell game works.

And, once you see it, you cannot unsee it.

The question is whether enough taxpayers and the newly elected board members of the North Bend School District will educate themselves to fight back, like the former members of the North Bend School District did.

Or, whether we will continue to fund our displacement while calling it progress.